When it comes to sales, many different kinds of charges and taxes could impact your overall price, overheads, and bottom line. It is therefore important to understand which taxes would impact your business. Two of the most common forms of tax for products and services are Sales tax and Excise tax. Although similar, there are key differences that need to be considered. In this article, we will compare Sales tax and Excise tax to help you understand the difference between the two, and how they might affect your business.

Sales Tax Overview

Sales tax is a tax levied on the sale of goods and services within the United States, that is collected by the seller and remitted to the government. Rates of Sales tax vary from state to state, and in some cases, from municipality to municipality, which means that extra consideration should be given to your tax compliance status.

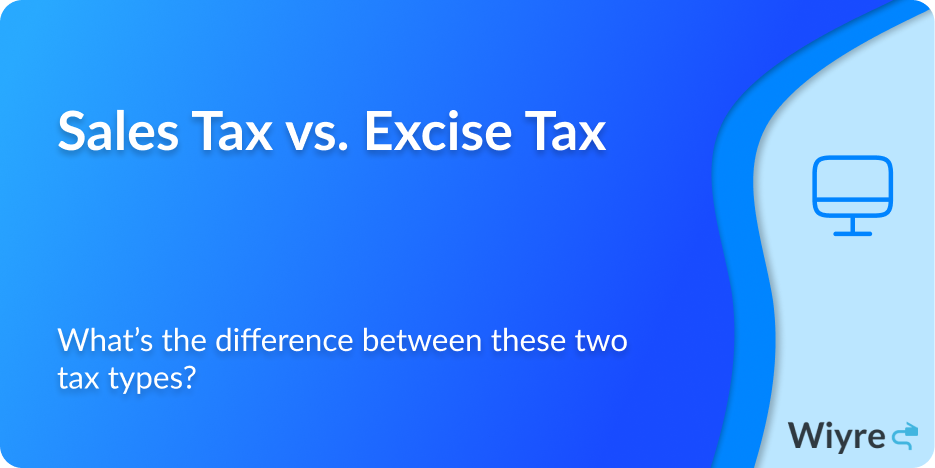

In most cases, however, the Sales tax amount is calculated by multiplying the purchase price of any given taxable item by the applicable Sales tax rate. The state determines the base rate with the local governments free to add their tax to the rate. In other words, the state could set its rate at 3.25%, the county may add 1%, and the local government an additional 0.5%.

The formula for the calculation is simple: Sales tax = List Price x Sales tax rate.

The collected Sales tax is then payable to the revenue service and remitted to the state and local government, as applicable, which is ultimately used to fund state and local government services such as infrastructure, public safety, law enforcement, fire department, and schools.

Excise Tax Overview

Excise tax is a type of indirect tax that is imposed only on certain goods and services such as tobacco, alcohol, gasoline, and firearms. Although Excise tax is also used to fund government expenditures and services such as infrastructure construction and maintenance, it is also commonly used to support social programs, fund public health initiatives, and discourage certain behaviors (also known as a “sin tax” in some cases).

There are two types of Excise tax, namely fixed taxes, specific taxes where the specific tax is a fixed dollar amount, or Ad Valorem taxes which are assessed as a purchase price percentage. The phrase “ad valorem” is Latin, and stands for “according to value”.

| Specific Excise Tax | Tax Liability = Quantity x Tax per Unit |

| Ad Valorem Tax | Tax Liability = Price Per Product x Tax Rate x Quantity |

For Excise tax, the rate of tax varies based on the type of product or services being taxed and is also calculated as a percentage of the purchase price or value of the item.

Sales Tax vs Excise Tax – Key Differences

Method of Collection

Sales tax is a direct tax collected by the sellers and retailers at the point of sale, while Excise tax is an indirect tax collected by the government such as in the form of fees, duties, and tariffs.

Exemptions

Sales tax applies to all retail items and services, whereas Excise taxes are typically only applied to specific goods and services.

Rates and payment structure

Sales tax is a flat rate, subject to the rates per state (or municipality), while Excise taxes are often tiered and calculated based on the quantity or volume of the goods purchased.

Revenue allocation

Sales tax revenue is usually allocated to the state or local government, while Excise tax revenue is typically allocated to the federal government.

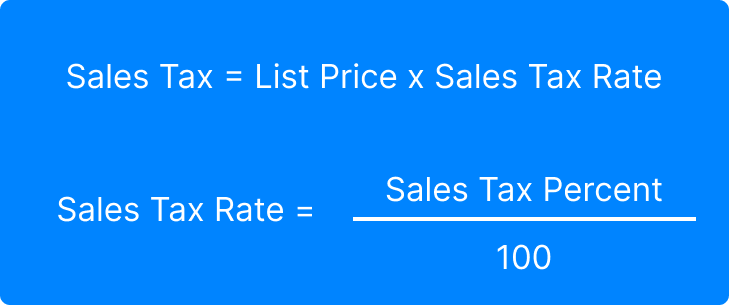

Taxpayer

Sales tax is paid by the consumer, while Excise tax is paid by the business or producer. Just because an excise tax is paid for by a business does not mean that the business will not pass along the tax to you. This is common when you fill up your car with gas, while the business pays the gasoline Excise tax, you as the consumer will pay a higher gas cost to cover the additional Excise tax fee.

Frequently Asked Questions

No, Sales tax and Excise tax are not the same. They differ in many ways such as the rate and payment structure, the type of taxpayer, the revenue allocation, and the method of collection, among other things.

No. Sales taxes are not uniformly applied and could vary by state, county, and even city. Each jurisdiction has its own rules regarding which types of businesses must collect Sales taxes and how much they must charge.