A D-U-N-S Number (also abbreviated as “DUNS”) is a unique nine-digit identification number assigned by Dun & Bradstreet (D&B) to a business or organization. It’s used to identify and track companies and their creditworthiness, and is often required for business-to-business transactions, government contracts, and other financial transactions. A common requirement for many online businesses is to register for a DUNS number in order to sign up for the Apple and Google Play Developer Programs or to apply for government grants.

Does a small business need a DUNS number?

It is not legally required for a small business to have a DUNS number, but having a one can make it easier for a small business to obtain business loans and access other services offered by D&B. Additionally, many government agencies and suppliers require a DUNS number as part of their vendor registration process, so having a DUNS number can open up new opportunities for a small business to work with government agencies and suppliers.

Applying for a DUNS Number

A company can obtain a DUNS number by registering with D&B on their website and complete the registration process. The registration process typically requires you to provide basic information about your business, such as its legal name, address, and your contact information, as well as information about the company ownership, structure, and operations.

If you have an online business or Shopify e-commerce store, make sure you include the URL of your business during the sign up process – your DUNS listing will be public, and it’s a great way to drive traffic to your business by including a link to your website!

Once the registration is complete, D&B will assign a DUNS number to the company, which can then be used to obtain business credit and access other services offered by D&B.

DUNS Number vs. EIN – What’s the Difference?

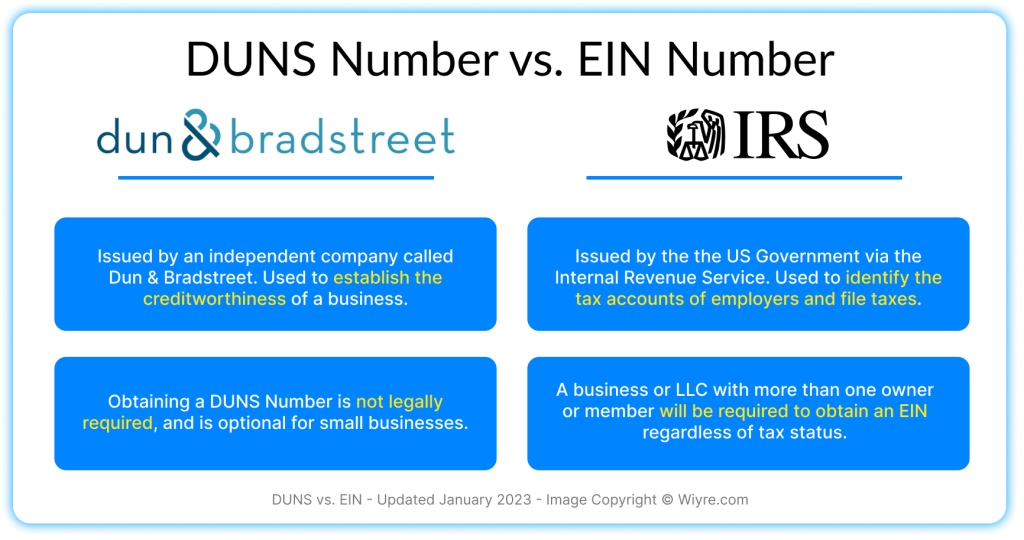

A DUNS Number and an Employer Identification Number (EIN) are both unique identification numbers assigned to businesses, but they serve different purposes. A DUNS number is used to establish the creditworthiness of a business and track its payment history, financial stability, and other factors that can affect its creditworthiness.

An EIN, on the other hand, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. It is also known as a Federal Tax Identification Number, and it is used to identify a business for tax-related matters such as filing taxes, opening bank accounts and applying for business licenses. Nearly every business or LLC with more than one owner (or member) will be required to apply and obtain an EIN number from the IRS.

How to lookup a DUNS number

Time needed: 5 minutes

To find your D-U-N-S Number, you can take the following steps

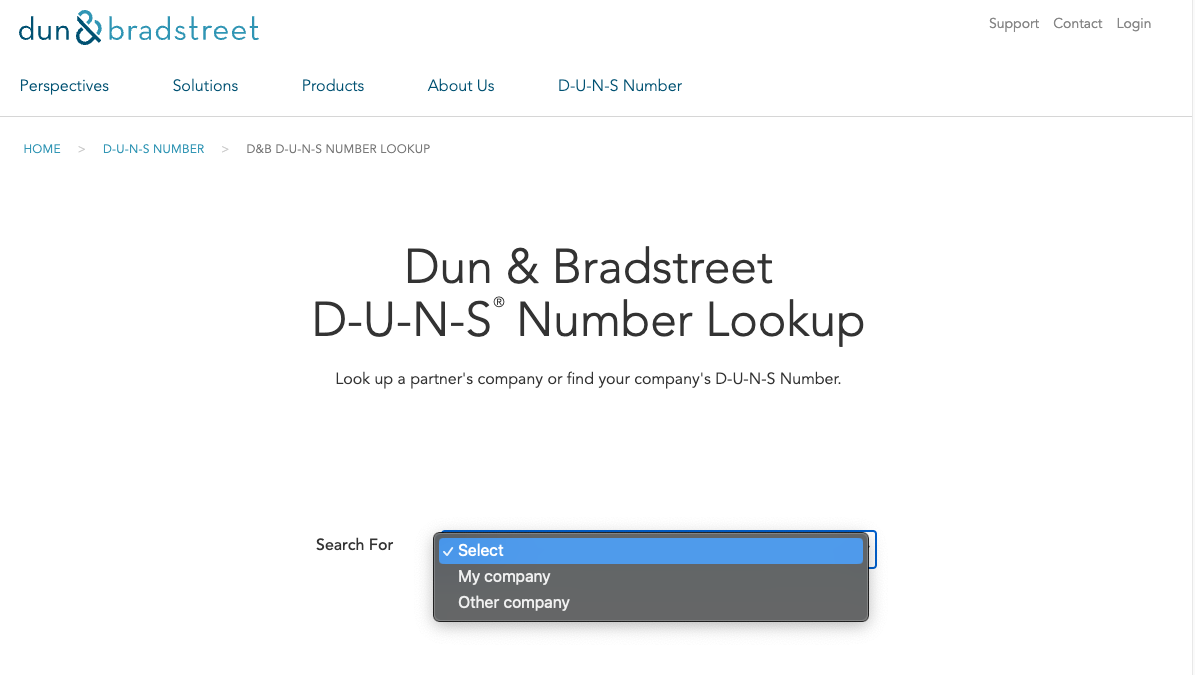

- Visit DUNS number lookup website

Visit the DUNS number lookup site directly via this URL: https://www.dnb.com/duns-number/lookup.html. Select whether you are searching for your company, or another company that doesn’t belong to you

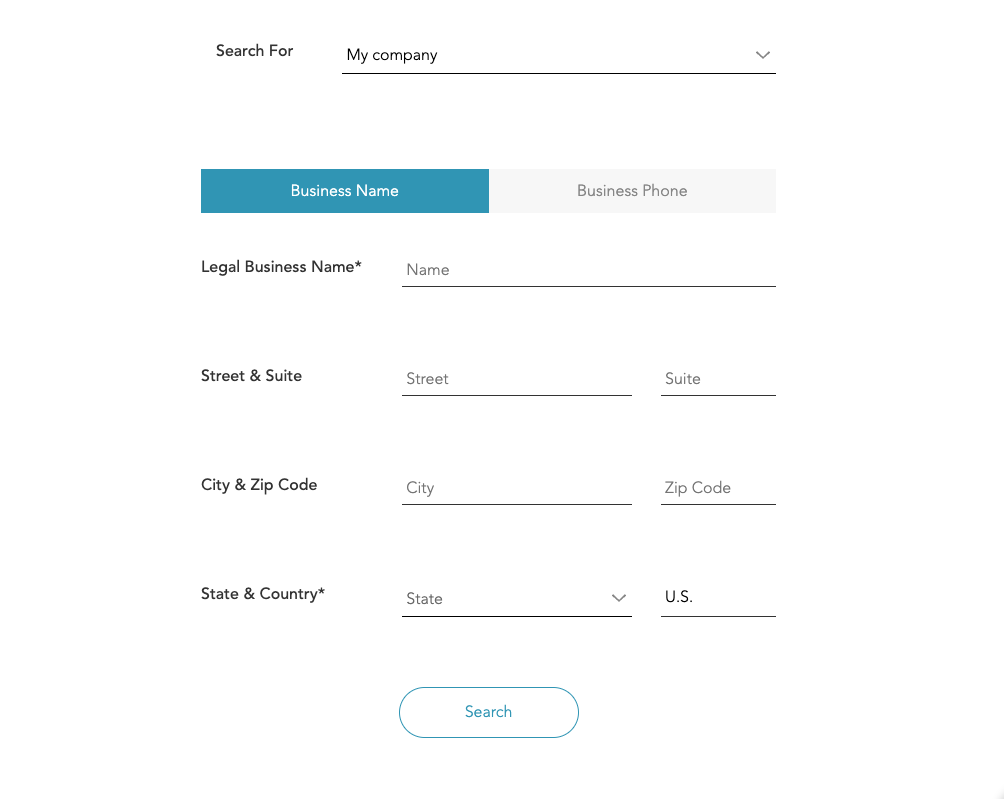

- Enter business details

Enter the details about your business or the business you’re searching for. Be sure to include as much information as possible.

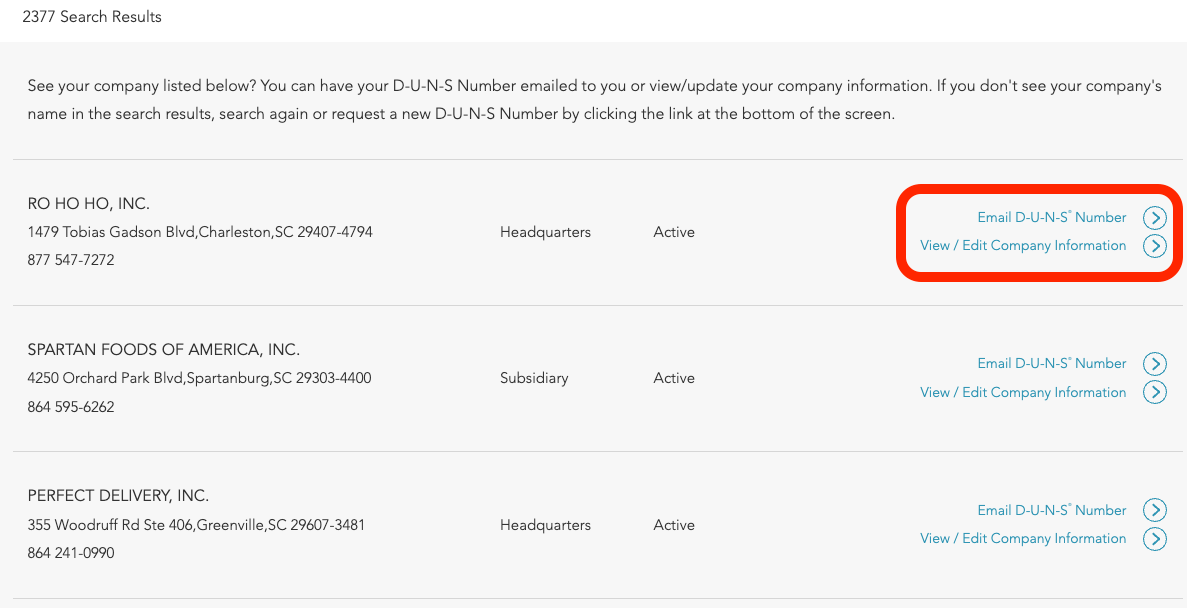

- Search and see results

Once you enter the business info, click “Search” to see if there is a valid business associated with DUNS. What I’ve noticed is that you need to make sure that the business name is completely correct, and also that the “State” you select corresponds with your business location, not the state that you registered your business in. Once you see your business, click on the “Email D-U-N-S Number” button.

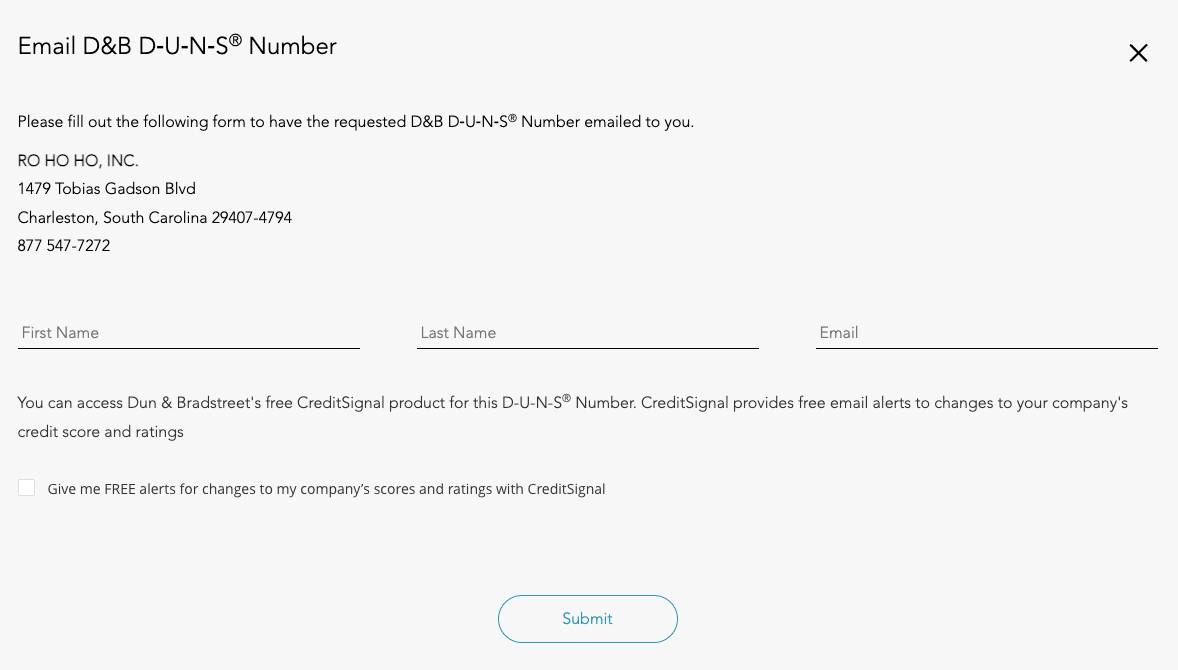

- Email D-U-N-S Number

Once you see your business, click on the “Email D-U-N-S Number” button. Enter your first and last name, email, and select whether your want business alerts.

- Check email for DUNS Number

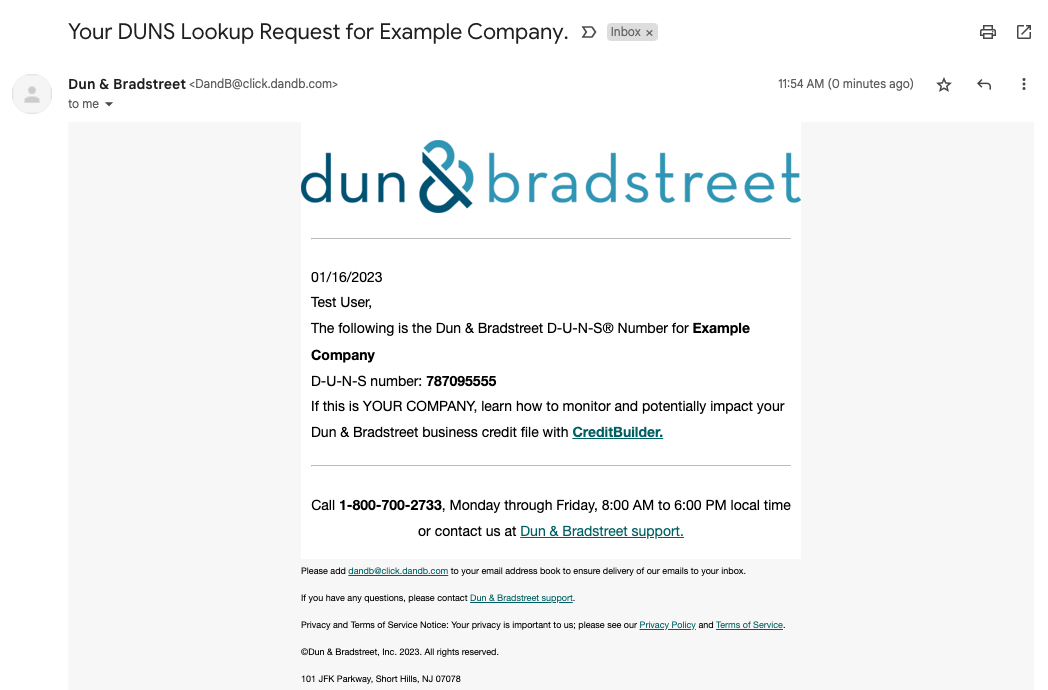

Check your email for an email from “[email protected]” – inside this email, you’ll see your DUNS number

If you are unable to find your DUNS Number through the lookup tool, you can contact D&B directly to request it. You may be asked to provide additional information to confirm your business identity (and also to ensure that you are a qualified owner or manager of the business).

Frequently Asked Questions

DUNS stands for (Data Universal Numbering System)

Signing up for a DUNS number requires a business registered with the state you are operating out of, but the process to obtain a DUNS number is completely free.

Typically DUNS numbers are issued with a week after you register your business with D&B, but it can take up to 30 days. If you need to expedite the request to create your DUNS number, you can pay $229 to D&B to use DUNSFile which will guarantee that you’ll receive your DUNS number within eight business days.