Over the past year I’ve been actively involved in putting money into Wealthfront, a so called “robo-advisor” that, for lack of a better explanation, invests your money for you in numerous diversified investment opportunities depending on the risk you are willing to take. I decided that would be a wise decision to invest my money instead of putting it into my checking or savings accounts for a measly return. I’ve tried other investment brokerages, but I really enjoy Wealthfront for its simplicity, low barrier to start investing and using the service, and overall value to me as an investor.

I’m going to try to go over the pros and cons of Wealthfront in layman’s terms, so that even if you don’t know too much about investing or how to handle money, you can still follow along and not be caught up in the financial jargon that is thrown around like some of the other money/finance/debt blogs out there tend to do. I’ll also try and explain some terms and what they mean, so consider this Wealthfront review a review for beginners who are just getting their financial feet wet.

What is Wealthfront? What does it do?

Wealthfront is an investment manager, plain and simple. The reason it is commonly referred to as a “robo-advisor” is that a regular “human” advisor is going to manually look up the types of investments that are available for you to take advantage of, and then divide your money up into each option, while taking a small cut for themselves. The person, normally referred to as an independent advisor or financial advisor is going to be the person responsible to ensure that your money is spread out amongst a variety of investments, depending on your risk tolerance. They are usually seasoned professionals who handle lots and lots of individual clients such as yourself. (Note: This is an extremely dumbed-down explanation of what an advisor does, but you get the idea.)

With Wealthfront, your money is the hands of a computer algorithm. Which kind of seems a bit concerning at first, until you realize that Wealthfront was made by a bunch of really sharp economists and investors (read the part below titled: “Information about Wealthfront as a company” for more details about who these people are). When looking at it this way – would you rather have one person in charge of your investments or a group of savvy economists and investment gurus that built a program to do it for you automatically? The choice is up to you.

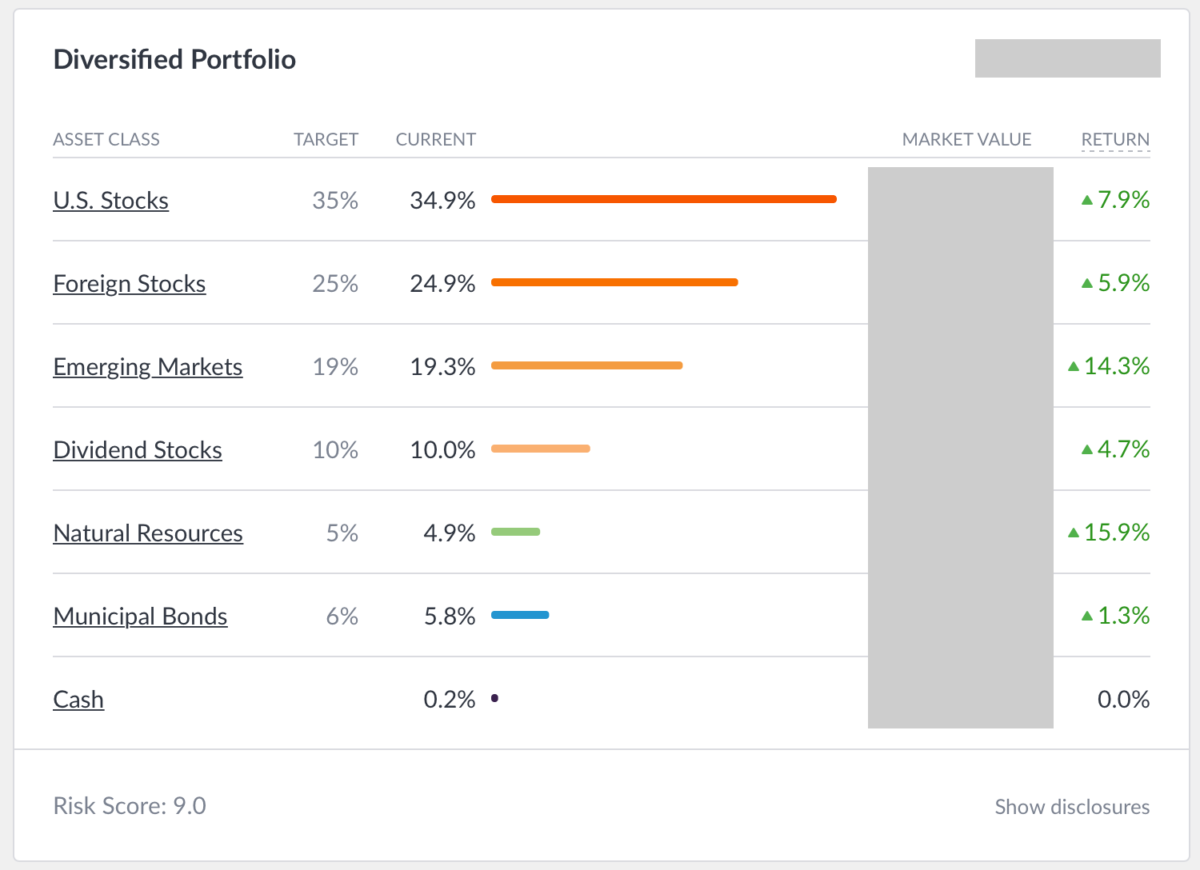

When you deposit money inside Wealthfront, your money is divvied up into 7 different asset classes. The percentage of your money that goes into each asset class is entirely dependent on your risk tolerance. The asset classes are shown below in a picture of my own portfolio, with an explanation as to what each one means below.

US Stocks – U.S. Stocks are an ownership share in U.S.-based corporations. U.S. Stocks act as the core asset class because history demonstrates that they offer significant returns over the long run. While more volatile than bonds, U.S. Stocks offer a great risk-adjusted return.

- Foreign Stocks – Foreign Stocks are an ownership share in foreign companies in developed economies like Europe, Australia and Japan. Foreign stocks differ from U.S. stocks in two ways. First, because markets outside the U.S. react differently to economic situations, foreign stocks help reduce a portfolio’s overall risk (to ensure that you don’t have all your eggs in one basket in the case of a US Economic Collapse, for example). Second, foreign stocks provide indirect exposure to currency fluctuations. The historical returns of foreign stocks are lower than U.S. stocks and have higher risk, so one of the main reasons for investing in foreign stocks are their diversifying qualities.

- Dividend Stocks – Dividend Growth Stocks are U.S. stocks that have a history of increasing their dividend payouts over time. They tend to be large-cap well-run companies in less cyclical industries and thus less volatile. As of this writing, many companies in this asset class have higher dividend yields than their corporate bond yields and the yields on U.S. government bonds. In the current low interest rate environment, Dividend Growth Stocks emerge as an asset class that offers an income stream and capital growth potential.

- Natural Resources – Natural Resources are investments that reflect the prices of energy (e.g. heating oil, natural gas, gasoline) and commodities (precious metals like gold and agricultural products like soybeans). Natural Resources provide a hedge against inflation. Wealthfront’s return expectations for Natural Resources have increased over the last five years due to the limited supply of natural resources and the growing demand from emerging market economies.

- Municipal Bonds – Municipal Bonds are debt issued by U.S. state and local governments. Unlike most other bonds, Municipal Bonds’ interest is exempt from federal income taxes. They provide individual investors in high tax brackets a tax efficient way to obtain income, low volatility and diversification.

- Cash – Wealthfront maintains a small cash reserve to provide a buffer against pricing fluctuations as they invest your funds as well as to cover your advisory fees you may incur, if any. This prevents Wealthfront from needing to sell securities and possibly incurring a taxable event in the event of low funds. There is only a small percentage of your money that is invested in cash, currently my own portfolio sits at below 1%.

So if Wealthfront invests my money across different asset classes and funds, why couldn’t I copy their advice and just invest my money myself?

You absolutely can. In fact, you could sign up for Wealthfront, put in the minimum deposit of $500, and just copy exactly where it puts your money in a regular Vanguard portfolio, for example. The reason that people, including myself, don’t go down that route is because:

A: It’s time consuming

and

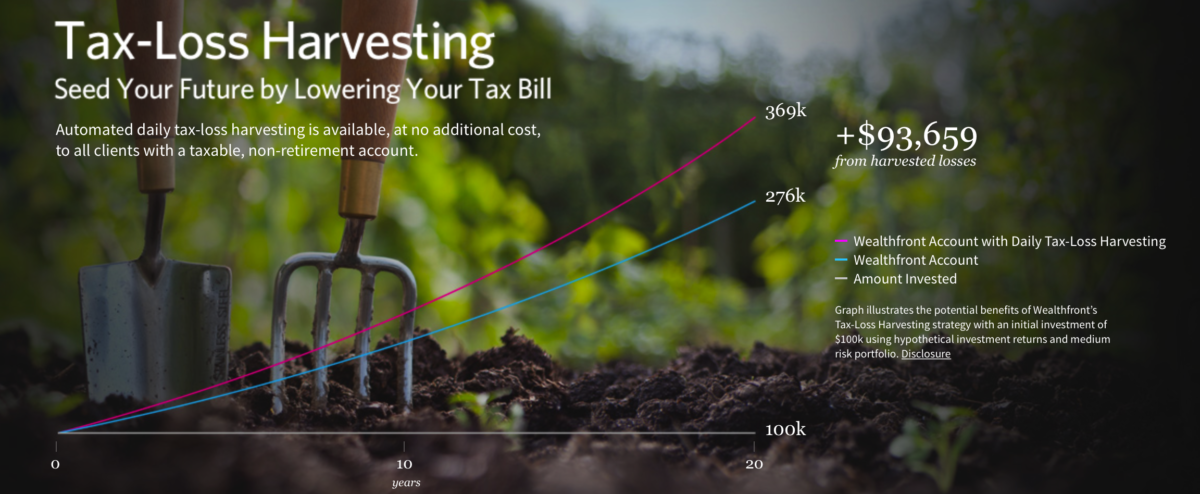

B: Wealthfront has some added perks such as the ability to take advantage of tax loss harvesting, see this video for information on what that means.

Another reason that I use Wealthfront is because it’s like having a financial advisor that never sleeps. Wealthfront is constantly rebalancing your assets to manage your risk all while taking advantage of tax loss harvesting, day or night.

What are the fees for using Wealthfront?

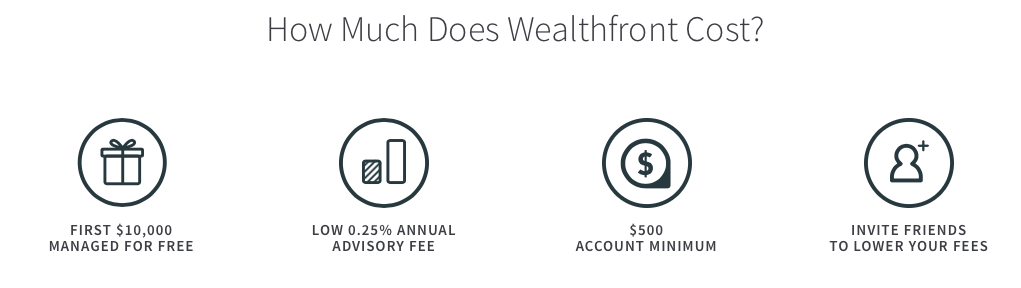

It’s pretty cheap. Using this link to a special promo, you can get your first $15,000 managed for free, instead of just the normal $10,000 limit. If you deposit anything over $15,000, you will be charged a 0.25% fee each year for any amount over $15,000. For example: if you had $16,000 in your Wealthfront account, only $1,000 would be charged at the 0.25% fee, not the full $16,000.

It’s hard for a regular financial advisor to match that level of affordability when it comes to using their service. Wealthfront can do it because they have hundreds of thousands of users with portfolios – your local financial advisor does not.

Regardless of whether or not you’ll be using Wealthfront or go with a traditional investment route, you’ll need to determine your risk tolerance. I keep coming back to this word “risk tolerance” because everyone’s risk tolerance is going to be different. I’m a young guy right of college with limited expenses and no dependents (ex: children). My risk tolerance is really high because higher risk = higher chance of reward. And even if something awful happens to the stock market or global financial markets in the next 5-10 years, it won’t really affect me that much because I won’t be retiring or pulling the money out of my investments. If you are not yet comfortable with investing, or getting closer to retirement, you’ll probably want a lower risk tolerance. When you sign up for an account with Wealthfront it will ask you what your risk tolerance is. I put mine at a 9 on a scale from one to ten, which means I am at the second highest level of risk tolerance.

It doesn’t really matter how much money you put in to begin with, but the minimum amount required to open an account is $500.

Why you should NOT use Wealthfront

You shouldn’t use Wealthfront if you have lots of time to personally manage your own investments and portfolio. If you have this time and energy to constantly monitor your investments and rebalance your portfolio, you should open up a Vanguard and do it yourself.

You also want to look at the pros and cons of opening a Wealthfront account if your investment amount is worth over $100,000. In this situation, there may be cheaper alternatives available to you – keep in mind that at $100,000+ you also can take advantage of Wealthfront’s other services including direct indexing. You should consider the pros and cons for both.

Information about Wealthfront as a company

I first learned about Wealthfront through some advertisements on Facebook. Then I heard about it again on Tim Ferris’ podcast and I had to take a look because Tim mentioned that he personally invested in the company and I thought that was enough incentive to go and take a look at it. In terms of the company structure, Wealthfront’s Chief Investment Officer is none other than Mr. Burton Malkiel, a Princeton economist who is probably best known from his book titled “A Random Walk Down Wall Street“, if you haven’t read it already, I highly recommend it.

How much can you earn using Wealthfront?

The answer, as with many investment services, is that it depends. If you have your risk set very high like me, you have the potential to make a great return. Note how I said potential: this is entirely determined the outcome of the investments that Wealthfront places for you, and as every investment manager and 401k option states very clearly in the terms and conditions: Past performance is no guarantee of future results. In my own personal account, I am up almost 10% YOY, but last week I was only at 7%, and for the first three months I was at a negative return. I simply have not had my money mature inside Wealthfront long enough in order to give an accurate representation of the estimated returns. With that said, my portfolio is performing well enough for me to continue putting money in each month and recommending it to other people.

That about sums up this review. Keep in mind that if you use my referral link (which you definitely don’t have to, but it would be great if you did!) you can get an extra $5,000 managed for free on top of the first $10,000 – meaning that $15,000 will be managed for free.

Final note: you should always do your prior research before putting your money into an investment. Wealthfront may be perfect for me, but you may find other options that are better for your current financial situation. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in loss. Whichever one you choose – choose wisely!

Great review! Thanks

Glad you found it helpful Jim!